Compare N26 bank accounts

Find the perfect plan for you

Find the perfect plan for your business

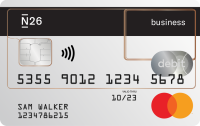

N26 Standard

The free* digital business bank account with cashback for freelancers

€0.00/Month

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

N26 You

The business bank account with cashback and travel perks for freelancers

€9.90/Month

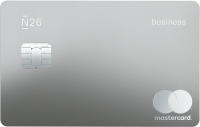

N26 Metal

The premium bank account with cashback and a metal card for freelancers

€16.90/Month

N26 Standard

The free* digital business bank account with cashback for freelancers

€0.00/Month

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

N26 You

The business bank account with cashback and travel perks for freelancers

€9.90/Month

N26 Metal

The premium bank account with cashback and a metal card for freelancers

€16.90/Month

*Please note that interest rates for each type of membership are subject to change.

**The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

Services and Fees are for anyone who registers with an address in Belgium, Estonia, Finland, Greece, Ireland, Lithuania, Luxembourg, The Netherlands, Portugal, Slovakia, Slovenia, Sweden, Norway, Denmark, Poland, Iceland and Liechtenstein.

For our detailed price list, view PDF here

For more information on Allianz Assistance insurance coverage, please see the General Conditions of the N26 You, N26 Business or N26 Metal account.

Bank Account for Freelancers FAQ

Can I have a regular N26 bank account and an N26 Business account at the same time?

No. With N26, you can only have one active account in your name. Currently, it’s not possible to have two N26 accounts under the same name. This means that you can’t have a private N26 bank account and an N26 business account at the same time.

How do I open an N26 Business bank account?

To open an N26 Business account, you must meet our eligibility criteria. If you do, simply register on our website, or by downloading the N26 app onto a compatible smartphone. Opening your business bank account takes only minutes and is done without paperwork. Once you’ve verified your identity, your business bank account will be ready to use.

For more information on opening an N26 Business bank account, as well as the documents that you need, visit our Support Center.

What are the Eligibility Requirements?

- You will use the account primarily for business purposes.

- You’re not already an N26 user.

- You reside in a country where N26 operates: Germany, Austria, France, Italy, Spain, Portugal, Ireland, Greece, the Netherlands, Belgium, Luxembourg, Finland, Latvia, Estonia, Lithuania, Slovakia, Slovenia

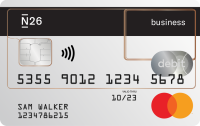

Should I open a business bank account with my personal name or business name?

To sign up for a N26 Business account, you must use your personal name and last name. The N26 Business bank account is designed for self-employed and freelance users doing business under their own name. That means you can’t have your company’s name on the account or card.

Do I need a business bank account if I’m self-employed?

N26 Business bank account is designed for freelancers and the self-employed, and you must register with your personal first and last name. A business bank account is a smart investment to separate your business finances from your personal banking. A dedicated business bank account will make for easier accounting and bookkeeping as you grow your business. With N26 Business, you can manage your business finances from anywhere, on your smartphone or via the WebApp on desktop.